Roth IRA vs. 401(k): Which Is Better for you?

There are some points in your life where you have to pick a side: Friends or Seinfeld? Marvel or DC Comics? Michael Jordan or LeBron James?

As important as those questions are for you and your friends, there’s one debate that could actually have a huge impact on your future—your retirement future: Roth IRA or 401(k) . . . which one is better?

No matter what your retirement dream looks like, you’ll need money to turn those dreams into a reality. After all, those summer vacations you want to take or that lake house you’ve always wanted aren’t going to pay for themselves! And the truth is that a Roth IRA and a 401(k) are both great ways to build wealth for retirement.

Once you understand how both plans work, you can see how they can work together to help you maximize your savings. And that’s not just fancy investing talk. Your choices today could result in thousands—if not millions—of dollars down the road! Let’s go ahead and dive right in, shall we?

What Is a 401(k)?

A 401(k) is a retirement savings plan many employers offer as a way to encourage employees to save for retirement. Basically, you tell your employer how much you want to invest in your 401(k)—usually as a percentage of your salary or a specific amount each pay period—and that money is automatically taken out of your paycheck and put into retirement savings. Voila!

According to Ramsey Solutions’ The National Study of Millionaires, 8 out of 10 everyday millionaires built their wealth through their company’s 401(k).If all those millionaires could use the boring, old 401(k) to get to millionaire status, so can you!

Advantages of a 401(k)

Let’s take a look at some of the main advantages of a 401(k):

- Higher contribution limits. In 2022, you can invest up to $20,500 a year in a 401(k), 403(b) or in most 457(b) plans—not including the employer match. That’s a lot of money! If you’re 50 or older, you can add an additional $6,500 per year, for a total of $27,000.

- Employer match. This is the big one! Probably the best thing about a 401(k) plan is that your employer can match your investment up to a certain amount. That’s a 100% return on your investment right off the bat! Matching isn’t required by the government, so not all employers offer it. If yours does, make the most of it. Don’t overlook free money!

- Your contributions lower your taxable income. Since you invest in your 401(k) with pretax dollars, that means you’ll pay less in income taxes when tax season rolls around. Sorry, not sorry, Uncle Sam!

- You can take it with you. And here’s some peace of mind: The money you invest in your 401(k) is all yours. You can roll over your 401(k) account to a Roth IRA if you get a new job or your company goes out of business.

Disadvantages of a 401(k)

Your 401(k) is a great way to save for retirement, but you also need to understand a few of its shortcomings too:

- Fewer options for mutual funds. Your employer usually hires a third-party administrator to run the company’s retirement plan. That administrator picks and chooses which mutual funds you can invest in, limiting your options. Womp-womp.

- Your withdrawals in retirement will be taxed. Remember those tax breaks you get on your 401(k) contributions? Well, there’s a catch.Since you fund a 401(k) with pretax dollars, you won’t pay taxes now, but you will pay taxes on that money in retirement. This could lead to a pretty hefty tax bill depending on what tax bracket you’re in when you retire.

- Required minimum distributions (RMDs). You can’t leave your money in your 401(k) forever. Beginning at age 72, you must start withdrawing a certain amount of your savings each year, or you’ll pay a penalty. Also—there are penalties for withdrawing money before age 59 1/2. Either way, Uncle Sam wants his share!

- Waiting period. If you’re new to a company, you may have to wait a certain length of time to participate in a 401(k) plan or receive an employer match. That’s not great, but some things are worth the wait!

Now that we’ve broken down the 401(k), let’s turn our attention to the one and only Roth IRA. Then we’ll compare the two and see if there’s a clear winner!

What Is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a retirement savings account you can open yourself. When you hear the word Roth, your ears should automatically perk up—because a Roth IRA allows your savings to grow tax-free. That’s right: tax-free. That means once you turn 59 1/2, you can withdraw money from your account, and you won’t owe a penny in taxes!

Advantages of a Roth IRA

Here are some advantages a Roth IRA has over a 401(k):

- Tax-free growth. Unlike a 401(k), you contribute to a Roth IRA with after-tax money. Translation? Since you invest in your Roth IRA with money that’s already been taxed, the money inside the account grows tax-free and you won’t pay a dime in taxes when you withdraw your money at retirement. And here’s the deal: Once you’re ready to retire, the majority of the money in your Roth will be growth. So, no taxes on that growth means hundreds of thousands of dollars stay in your pocket. That’s worth a happy dance!

- More investing options. With a Roth IRA, you’re not limited by some third-party administrator deciding which funds you can invest in—you literally have thousands of mutual funds to pick and choose from. When you have more options, you have more power to make good choices!

- Not tied to your employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time. And no matter what your employment situation is, it doesn’t affect your Roth IRA at all. No need to roll over anything or worry about keeping track of a pile of 401(k)s you left behind from old jobs!

- No required minimum distributions (RMDs). With a Roth IRA, you can keep your money in the account forever if you’d like. That means you can let more of your money keep growing over a longer period of time!

- The spousal IRA. If you’re married but only one of you earns money, you can still open a Roth IRA for the nonworking spouse. The spouse who earns money can invest in accounts for both spouses—up to the full amount! On the other hand, only the employee of the company offering a 401(k) can contribute to their 401(k).

Disadvantages of a Roth IRA

The Roth IRA sounds pretty awesome, doesn’t it? Unfortunately, the Roth IRA does have some limitations that you need to be aware of:

- Lower contribution limits. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if you’re age 50 or older. When you compare that with the contribution limits for a 401(k), you might be thinking, That’s it? That’s why 401(k)s and Roth IRAs work better together.

- Income limits. As amazing as the Roth IRA is, there’s a chance you might not even be eligible to put money into one. Gasp! If your modified adjusted gross income (MAGI) is higher than $144,000 as a single person or more than $214,000 as a married couple filing jointly, then you won’t be able to contribute to a Roth IRA in 2022. But don’t worry, the traditional IRA is still an option—it’s better than nothing!

- The five-year rule. This won’t be an issue for most folks, but the five-year rule says you can’t take money out of your Roth IRA until it’s been at least five years since you first contributed to the account. You’ll get hit with taxes and penalties if you break that rule (so don’t do that). And remember: Just like the 401(k), you’ll be penalized for taking money out of a Roth IRA before age 59 1/2 (don’t do that, either).

Roth IRA vs. 401(k): What Are the Major Differences?

Okay, folks, does anybody else feel like they’ve been drinking water from a firehose? That was a lot of information! Here’s the tale of the tape showing how the Roth IRA and the 401(k) stack up against each other:

| Feature | 401(k) | Roth IRA |

| Eligibility | Only available through employer-sponsored programs. May be a waiting period before enrollment. | Must have earned income, but restrictions apply after a certain income based on your filing status. Married couples with only one income earner may open a spousal Roth IRA. |

| Taxes | Contributions are made with pretax dollars, lowering your taxable income. You’ll pay taxes on any money you withdraw in retirement. | Contributions are made with after-tax dollars, allowing investments to grow tax-free. No taxes on withdrawals in retirement. |

| Contribution Limits | For 2022, $20,500 per year ($27,000 per year for those 50 or older). Additional contribution limits may apply to Highly Compensated Employees (HCEs). | For 2021 and 2022, $6,000 per year ($7,000 per year for those age 50 or older). |

| Employer Contribution | Many employers offer a match based on a percentage of your gross income. | No matching contribution. |

| Required Minimum Distributions (RMDs) | Beginning at age 72, you must start taking out a certain amount each year (RMD) to avoid penalties. | No RMDs. The money can sit in your account as long as you live. |

| Investment Menu | Account is controlled by a third-party administrator who handles (and limits) investment options. | A wider variety of investment options and more control over how you invest. |

| Penalties | Penalties withdrawals before 59 1/2. | Penalties for withdrawals before 59 1/2. |

How to Make a 401(k) and Roth IRA Work Together

OK, so now we’ve arrived at the moment of truth: Should you put your money in a 401(k) or a Roth IRA? The answer is . . .yes!

If you’re eligible for a 401(k) and a Roth IRA, the best-case scenario is that you invest in both accounts (and if you can max them both out—knock yourself out!). That way, you’re taking advantage of your employer match and getting the tax benefits of a Roth IRA.

The best way to remember where to start is with this rule: Match beats Roth beats Traditional. An employer match is free money, and you simply don’t leave free money on the table—so that’s where you start!

After that, you take the tax advantages of Roth accounts like a Roth IRA (tax-free growth and withdrawals in retirement) over traditional IRAs and their tax-deferred growth (which means taxes on withdrawals in retirement) every time. It pays off more in the long run!

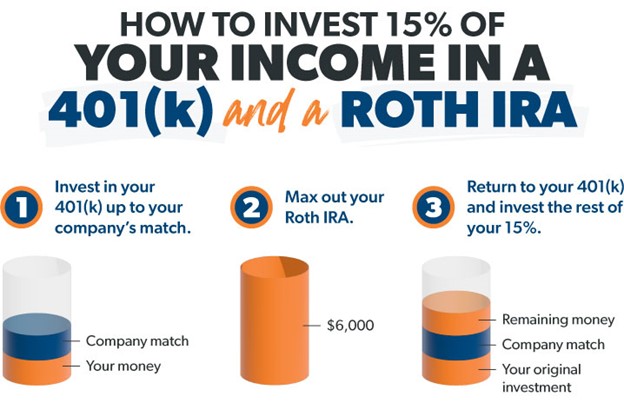

Here’s how that works in three simple steps: Let’s say you make $60,000 a year and you’re under 50. Once you’re debt-free and have a fully funded emergency fund, your goal is to invest 15%—$9,000 in this case—in retirement.

- You start by investing in your 401(k) up to the match your company offers. Let’s say, in this case, that it’s 3% of your gross income ($1,800). You invest $1,800 in your 401(k) to reach the employer match. This leaves you with $7,200 more to invest.

- Then, you max out your Roth IRA. You can only contribute $6,000 in 2022, so that leaves you with $1,200.

- Return to your 401(k) and invest the remaining $1,200.

Remember, if you’re older than 50 and behind on your retirement savings, you can make catch-up contributions to max out your Roth IRA at $7,000 and your 401(k) at $27,000 in 2022. Oh—and remember this about the employer match on your 401(k): While it’s nice to have, don’t count it toward your 15% goal. Think of it like icing on the cake of your own contributions.

Some companies offer a Roth 401(k), which combines many of the benefits of a 401(k) and a Roth IRA. If you work at a company with a Roth 401(k), that makes your situation a lot easier. If you like your investment choices inside the plan, you can simply invest your entire 15% in your Roth 401(k) and you’re done!

The Best Choice

So, to sum it all up: Your best choice is to invest in your 401(k) up to your match and then invest in a Roth IRA—and make sure you reach your goal to invest 15% of your gross income in retirement!

Always seek good advice and invest in good growth stock mutual funds with a history of strong returns. They’re the best way to use the power of the stock market to build wealth over the long term. And steer clear of trendy, “sophisticated†stuff like the latest “hot†single stock, precious metals or cryptocurrency. Keep things simple and never invest in anything you don’t understand!

Here’s the deal: Investing is worth the hard work. If you don’t save and invest now, you won’t have anything to live on in retirement. It’s a big goal, but you don’t have to do this alone.

Talk with an investment professional like one of our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your investment options and create a plan for your situation.

Ramsey Solutions