SAVE Repayment Plan: Simplified Loan Relief and Flexibility

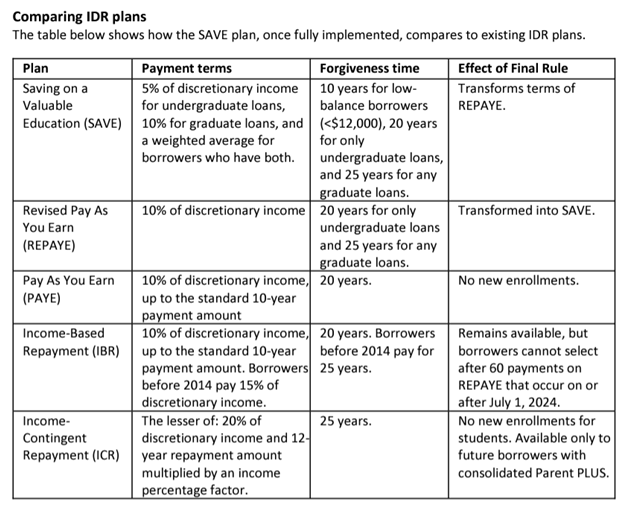

The Saving on a Valuable Education (SAVE) Plan is set to revolutionize student loan repayment options, replacing the existing Revised Pay As You Earn (REPAYE) Plan. Aimed at providing relief to borrowers burdened by student loans, the SAVE Plan calculates monthly payment amounts based on income and family size, offering unparalleled benefits to nearly all student borrowers. This article presents eight key facts about the SAVE Plan and its potential impact on borrowers.

1. Automatic Enrollment and Increased Income Exemption

Borrowers currently on the REPAYE Plan will automatically receive the benefits of the SAVE Plan. The new plan increases the income exemption from 150% to 225% of the poverty line. This change can significantly lower monthly payment amounts compared to other income-driven repayment plans, offering relief to those facing financial constraints.

2. Elimination of Remaining Interest

A significant feature of the SAVE Plan is its elimination of 100% of remaining interest for both subsidized and unsubsidized loans after a scheduled payment is made. By preventing unpaid interest from accumulating, borrowers can keep their loan balance from growing, providing financial stability in the long run.

3. Exclusion of Spousal Income for Married Borrowers

The SAVE Plan removes the requirement for spousal cosigning for married borrowers who file taxes separately. This change simplifies the application process and ensures borrowers can independently access the benefits of the plan without relying on their spouse’s income.

4. Application Process and Timing

The application process for the SAVE Plan is underway through a beta version of the updated IDR application. Borrowers are encouraged to apply early to ensure a smooth transition to the new plan. Those already on the REPAYE Plan will be automatically transferred to the SAVE Plan.

5. Reduced Monthly Payments

Under the SAVE Plan, borrowers making $32,800 or less annually (approximately $15 per hour) will enjoy a $0 monthly payment. For those earning more, the SAVE Plan promises to save at least $1,000 per year compared to other IDR plans, offering valuable financial relief.

6. Future Benefits in 2024

Starting next year, borrowers on the SAVE Plan will experience a significant reduction in payments for undergraduate loans, halving the current rate from 10% to 5% of income above 225% of the poverty line. Borrowers with both undergraduate and graduate loans will pay a weighted average between 5% and 10% of their income based on the principal balances of their loans.

7. Automated Recertification and End of Interest Capitalization

In 2024, the SAVE Plan will integrate with the IRS to automatically access borrowers’ latest tax returns, streamlining the recertification process. Additionally, interest capitalization upon exiting IDR plans (except the Income-Based Repayment Plan) will be eliminated as of July 1, reducing overall debt burden.

8. Forgiveness and Credit Options

In July 2024, the SAVE Plan will introduce further benefits, including forgiveness of remaining balances after 10 years of payments for borrowers with original principal balances of $12,000 or less. Consolidated borrowers will not lose progress toward forgiveness, and additional catch-up payments will be introduced for periods of deferment or forbearance. For loan balances greater than $12,000, eligible for forgiveness after 20 years for only undergraduate loans, and 25 years for any graduate loans.

Final Thoughts

The SAVE Plan is set to transform the landscape of student loan repayment, providing borrowers with newfound financial flexibility and reduced debt burdens. With benefits such as automatic enrollment, elimination of remaining interest, and increased forgiveness options, the SAVE Plan offers a ray of hope for students struggling with loan repayments. By streamlining the application process and implementing advanced features, the plan aims to safeguard borrowers’ financial well-being and promote a smoother path to a debt-free future.

Learn more at StudentAid.gov!

There is an alternative to paying for 20 to 25 years, accelerate your payments by developing a debt reduction plan. Put these loans behind you quicker! Take charge of your financial future in 2023! Become a client and schedule a complimentary coaching session today and receive personalized guidance, a solid plan, and the ACCOUNTABILITY you need to make significant strides. Act now and seize the opportunity to achieve your financial aspirations. Your future is waiting – MAKE IT HAPPEN with coaching sessions.